1. INTRODUCTION

Flicking through any policy journal from the last decade, one will notice a singular theme popping up time and again: how to move money without it leaking away. In India, this puzzle matters most in farming villages, where a few thousand rupees can decide whether seed is bought on time or a family eats two decent meals a day. That is why the Direct Benefit Transfer (DBT) platform—a giant digital pipeline from the Union Treasury to an individual farmer’s bank account—has drawn so much attention.

The logic behind DBT is disarmingly simple. Instead of routing fertilizer and seed subsidies, crop insurance payouts, or income support through layers of district officers and local dealers, the government wires the money directly to the intended recipient. This single tweak in welfare policy wipes out rent-seeking middlemen, trims administrative costs, and lets farmers decide how best to spend the money.

The importance of agriculture in India makes the debate more than just an academic exercise. Roughly half the labour force still depends on farming for its primary income, and as every drought reminds us, the sector underpins food security for 1.4 billion citizens. If subsidies leak, entire districts wobble. And if they land on time, output rises, rural credit stress eases, and the economy as a whole breathes easier.

Against this backdrop, this case study aims to understand the impact of DBT on agriculture in India. The study utilises secondary data gathered from secondary sources such as government reports and research papers. Furthermore, the case study also draws on insights from interviews conducted by the author with farmers from the states of Uttar Pradesh, Haryana, and Maharashtra. These interviews serve as testimonies of the on-ground impact of schemes using the DBT framework to transfer and track benefits.

The case study is divided into two major sections. The first section provides a historical backdrop of the welfare regime, which aimed to provide benefits to farmers before the implementation of DBT. The second section aims to study the impact of DBT on the lives of farmers enrolled under the three flagship schemes: 1) Pradhan Mantri – Kisan Samman Nidhi (PM-KISAN); 2) Fertilizer Subsidy Scheme; 3) Pradhan Mantri – Fasal Bima Yojna (PM-FBY).

2. HISTORICAL CONTEXT

On 15 August 1947, India became free, but hungry. Food grain output barely scraped past 5 crores (50 million tonnes), which was well below domestic demand, and the balance of payments bled foreign exchange for wheat imports. It is no wonder that agriculture sat at the top of the first Five-Year Plan. The government’s initial toolkit—community development blocks, irrigation projects, concessional credit—contained the seeds of today’s subsidy regime, although nobody used that term back then.

Two decades later, the Green Revolution turbocharged output in Punjab, Haryana, and western Uttar Pradesh. High-yielding varieties (HYVs), assured prices, and subsidized fertilizers pushed wheat yields from 0.8 t/ha (tonnes per hectare) in 1965 to 2.5 t/ha by 1980. Victory, however, came with a price tag: massive input subsidies and a procurement cum price support system that the state struggled to finance even during the good harvest years.

By the late 1980s, farm support was no longer a short-term prop but a permanent feature. Three instruments dominated:

-

- Fertilizer subsidy – manufacturers were reimbursed the difference between the government-fixed selling price and their cost of production. Because the payment went to the firm and not the farmer, diversion to industry and cross-border smuggling became a lucrative side business. Gulati & Banerjee (2015) in their paper reckon that, in some years, a third of subsidized urea never reached Indian fields.

- Cheap power and water – state utilities charged flat or near-zero tariffs for electricity used for operating tubewells and canal water was practically free. This encouraged groundwater over extraction and skewed cropping patterns toward water-guzzling rice in semi-arid belts.

- Credit and insurance concessions – cooperative banks lent below market rates while the state-run crop insurance programme (launched in 1985 and revised repeatedly) promised relief due to weather-related damages, though settlement delays often stretched into the next planting season (Mukherjee & Pal, 2017).

On paper, these schemes looked generous. However, their on-ground impacts were blunted by four chronic defects:

a) Leakage

A web of dealers and local officials stood between the Treasury and the smallholder. Predictably, some shaved off a generous margin. In the fertilizer scheme, the leakage showed up as phantom sales; in credit, it appeared as priority sector loans granted to influential farmers owning tractors and at least ten hectares of land, and not to marginal cultivators. A 2011 audit report found that less than 60% of the intended subsidy value reached farms smaller than two hectares (CAG, 2012).

b) Targeting Errors

Lists of “eligible farmers” dated back to land records last updated in the 1960s. Ownership changes, tenancy agreements, and even deaths rarely made it into the registers. The outcome: genuine claimants were excluded while ghost names soaked up benefits. Sharma and Thaker (2010) estimated inclusion errors of 25-30% for seed subsidies in Gujarat alone.

c) Middlemen Capture

Because most subsidies were delivered in kind—bags of urea, cartons of seed—the last mile was monopolised by licensed dealers. These agents held the power to dictate supply (and sometimes compelled farmers to buy other products). Farmers complained, but alternatives were few when the nearest cooperative shop lay 20 km away.

d) Fiscal Stress and Perverse Incentives

Input subsidies ballooned from roughly ₹300 crores ($35 million) in 1976-77 to more than ₹1 lakh crore ($11.7 billion) by 2012-13 (Finance Account, 2013). Yet yields plateaued, soil health declined, and water tables fell. Economists warned that price-distorting subsidies then cost more than the food grain shortfalls they once solved.

Faced with runaway costs, policymakers toyed with tweaks to the schemes. Decannalizing phosphatic and potassic fertilizers in 1992 did curb those subsidies, but urea, the most commonly used fertilizer source, remained under price control. Smart card pilots in Karnataka tried to tie fertilizer purchase to land records; a few years later, Andhra Pradesh rolled out biometric payment cards for the rural employment guarantee wage bill. These scattered experiments proved two things:

-

-

- Technology could plug leaks, provided the backend databases were clean and accurate.

- Scale mattered—small pilots showed savings but fizzled when replicated without stable funding.

-

3. DBT ERA

At the start of the new millennium, the Aadhaar initiative was launched, building a biometric ID spine that would later carry the weight of DBT. More importantly, the new government in 2014 launched the Jan Dhan Yojana, which coaxed 470 million people, many of them farmers, into a formal banking network within the next five years (Singh, Kumari, Sharma, & Mehrotra, 2021). By the end of the decade, the hardware—unique IDs, bank accounts, mobile connectivity—was finally in place.

DBT promised a different route: pay the farmer first, let him/her choose inputs, and audit funds post facto through digital trails. Early pilot in 2016-17 in 19 districts across the country, 2016-17 cut fertilizer diversion considerably. Encouraged by the outcome of the pilot project, the Centre announced an all-India fertilizer DBT rollout in 2018. Similar thinking underpinned the PM KISAN income support scheme (2019) and the revamped Pradhan Mantri Fasal Bima Yojana, which wired compensation directly once remote sensing data confirmed crop loss.

To get a comprehensive understanding of the impact of DBT in agriculture, we need to study three major schemes in detail. The following section presents an in-depth analysis of the three flagship schemes introduced for the well-being of our farmers.

3.1) Pradhan Mantri – Kisan Samman Nidhi (PM-KISAN) –

a. Historical Context – According to the 10th Agricultural Census (2015-16), more than 86% of the land holdings (operational holdings) in India were of 2 hectares or less. These holdings are officially classified as marginal and small land holdings. Further, according to the 77th round of the NSS survey conducted in 2019, the average monthly income of a farmer was around ₹10,000. Further, the same data set also revealed that around 50% of agricultural households had taken a loan to cover their expenses. The average amount of outstanding loans per household was more than ₹70,000.

b. Aim – Given this backdrop, PM-KISAN became operational on 1st December 2018 and was aimed at farmers with marginal and small land holdings. The scheme provides an annual income support of ₹6000 in 3 instalments. On 1st April 2019, the scheme was expanded to cover all land-holding farmers, barring a few exclusions. The two primary aims of the scheme are as follows

i. The scheme aims to provide supplemental income support to all land-holding farmers for procuring agricultural inputs like seeds, fertilizers, etc. However, the untied nature of the transfer also allows farmers to utilise the transfer to cover even non-agricultural expenditures.

ii. The scheme, by providing income support, also aims to act as a safety net against indebtedness.

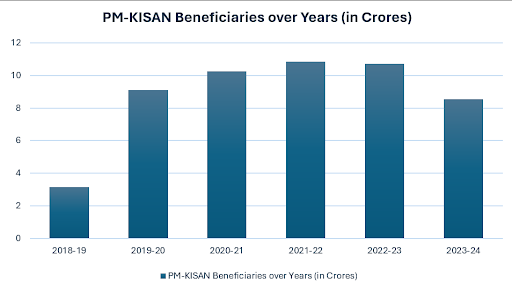

c. Financial Allocation and Beneficiary Data – Even a cursory look at the data for PM-KISAN will show that it has been able to reach our farmers at an unprecedented rate. In its second year, the scheme was able to benefit more than 9 crore farmers, which was a 300% increase from the number of beneficiaries in the first year. Since then, the scheme has seen increased adoption. However, data also shows a dip in the number of beneficiaries in 2023-24, which might be due to the adoption of stricter validation criteria requiring digital verification of Aadhar seeding, land records, and other similar records. Further, PM-KISAN also provides an option for voluntary renunciation of benefits by the farmers, a choice that has been utilized frequently.

Figure 1 – Number of Beneficiaries Enrolled in PM-KISAN (in Crores) [Source: PIB]

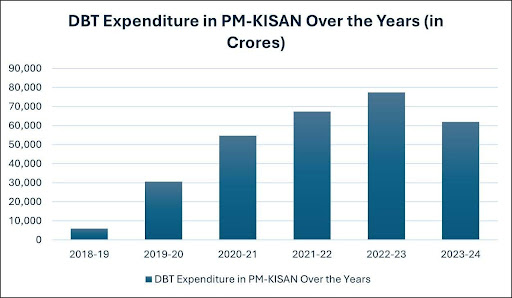

Figure 2 – DBT Expenditure in PM-KISAN (in Crore Rupees) [Source – DBTBharat]

Figure 2 provides a snapshot of the amount disbursed under PM-KISAN since its inception. The data mimics the trend seen in the case of the number of enrolled beneficiaries (Figure 1). Further, the financial data also reveals that PM-KISAN, due to the efficiency of DBT, has been able to handle an exponential increase in the volume of funds transferred, making it one of the biggest schemes in a relatively short span of time.

d. Impact – Several studies have highlighted the benefits of PM-KISAN with results showcasing that more than half of the beneficiaries use the funds primarily on agricultural expenses (Ghosh B., et.al, 2024; Padmaja B., et.al, 2024). These expenses include the purchase of seeds and fertilizer, the renting of irrigation and harvesting equipment. Further, studies have also observed a growth in the portion of funds being utilised for non-agricultural expenses, highlighting the exercise of choice regarding fund utilisation by beneficiaries (Padmaja B., et.al, 2024; Burman R., et.al., 2024). This income support has been crucial for building a more sustainable consumption pattern, helping fight economic shocks due to unforeseen circumstances, and developing capabilities through education or skill development (especially for young people).

These expenses include the purchase of seeds and fertilizer, the renting of irrigation and harvesting equipment. In addition to the secondary sources, the author’s interaction with farmers has revealed the transformational impact of the scheme. A few prominent cases are presented below –

i. Agricultural Expenditure –

-

-

-

-

- Shri Ram Naresh, a farmer from Jhansi district, Uttar Pradesh, told the author that the funds received by him under PM-KISAN have been crucial for him in procuring peanut seeds during the 2024 kharif season. He needed ₹10,000 to buy the required quantity of seeds, but only had ₹8,500. Hence, using the money from the 16th installment of PM-KISAN, he was able to arrange enough money to procure the required quantity of seeds for his farm.

- Shri Surender Chauhan from Bhiwani district in Haryana told the author that he has been saving money from instalments of PM-KISAN in order to create an emergency fund that will cover any deficit during a farming season. He gave the example of the 2023 Rabi season, where he needed a combine harvester for 4 days but did not possess enough money due to the expenditure incurred by him for his daughter’s marriage a few months ago. During this tough time, he used savings from PM-KISAN to ensure that he was able to proceed with the harvesting without any delays.

-

-

-

ii. Non-Agricultural Expenditure –

-

-

-

-

- Shri Sunil Vidhate is the primary breadwinner of a family of 7. He, along with 2 of his sons, works on their 1.5-hectare farm in the Amaravati district of Maharashtra. Last year, in 2024, Sunil’s mother suffered a stroke, which left her paralysed. The sudden nature of the event left Sunil searching for financial resources to cover his mother’s healthcare expenditure. He was left with no other option than to utilise his savings from the last harvest. Since his mother was discharged from the hospital, Sunil must purchase medication worth ₹3,000 every month. In early October, he faced a shortage of money, which left him unable to purchase the medicine. He had to wait around 20 days to be able to get money from that season’s harvest, and he had to arrange for medicine till then. He had thought of taking a small loan from his local moneylender, but his son suggested that he should use the money from PM-KISAN to purchase a supply of medicine till they receive money from the sale of their crops. According to Sunil, money from PM-KISAN came as a lifeline for him and many other farmers in the locality to manage similar unexpected expenses, which previously were a source of major worry.

- Shri Anil Kumar and his family of 5 have been working on their farm in the district of Kanpur Dehat for the last 4 decades. The family has two daughters aged 11 and 16 years respectively. The elder daughter shifted to a higher secondary school last year. However, the school is seven km from their home. Further, the location of the family’s house and their financial condition do not allow them to arrange a permanent transportation arrangement for their elder daughter. This, in the initial months of the academic session, led to high absenteeism. However, both Anil and his wife were determined to send their daughter to school as they dreamt of her going to an engineering college after her schooling. Hence, putting together the money he received from PM-KISAN and some previous savings, Anil bought his daughter a bicycle, which has allowed her to travel to school with ease. According to him, PM-KISAN has gone a long way in supporting his dream of educating his children for them to reach greater heights.

-

-

-

iii. Bringing Dignity to Farmers’ Life – A common strand connecting the experience of farmers mentioned above and so many more is the fact that the money received from PM-KISAN has provided a much-needed support to the beneficiaries to cover their expenditure (both foreseen and unforeseen). Hence, one of the biggest benefits of the scheme has been its ability to reduce the reliance of farmers on local moneylenders. Loan from moneylenders, regardless of the sum, has always come associated with exorbitantly high interest rates, leading to the entrapment of farmers in a debt cycle. This has, in turn, brought dignity to the lives of farmers as they can rely on transfers from the government without borrowing money for basic needs.

A stark example of the benefits of PM-KISAN can be gauged by the case of Shri Chote Lal from Etah district of U.P., who has been able to utilise the financial support from PM-KISAN to repay his debts of ₹40,000 to his local moneylender. According to him, PM-KISAN has supplemented his savings in the goal of being debt-free and hence, released him from the humiliating cycle of being unable to pay his debt and brought dignity to him and his family.

3.2) Fertilizer Subsidy –

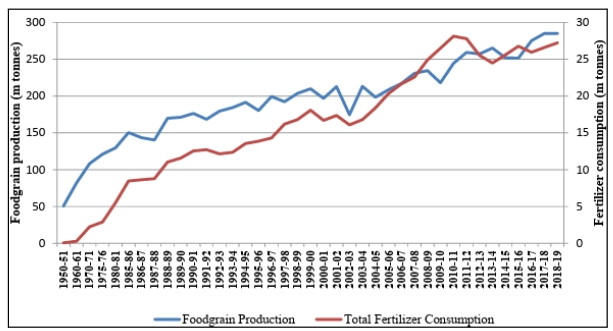

a. Historical Context – The requirement of fertilizer in India has grown drastically since our independence. This has been the case due to a recognition that land under cultivation is a finite resource, and hence, the only path to fulfill the demands of raw food materials is to increase the productivity of land. The three major forms of fertilizer used by the Indian farmer are Urea (CO(NH2)2 – which provides nitrogen to the crop; Phosphorus (P2O5); and Potassium (K2O). In this regard, Fig. 3 provides a snapshot of the rise in the quantity of food production along with the rise in demand for fertilizers (FAI, 2019). The rise of food production in our country has mirrored the rise in the production of fertilizer. Hence, it is clear that the role of fertilizer in increasing the yield of the farmland by increasing the nutrient content of the soil has been pivotal in ensuring food security in India.

For this reason, the government has recognised the importance of fertilizer to our farmers and hence, provided a subsidy on all forms of fertilizer. However, till 2015, the subsidy provided has been criticised due to its inability to reach the intended beneficiary due to its lack of accountability at the local level and diversion of fertilizers for farmers to industries engaged in non-agricultural production (NAAS,2020).

Figure 3 – Food Production with Demand of Fertilizer [Source – NAAS, 2020]

b. Aims – In the above context, in 2016, the government initiated a pilot project in 17 districts to test the feasibility of DBT in increasing the efficiency of fertilizer distribution. After its success, in 2018, DBT became the default mode for transferring subsidies for fertilizer across the whole country. However, it is important to note that the subsidy amount does not go directly to the beneficiary, instead it is still being transferred to the account of the [fertilizer] producer, but in contrast to the previous regime, the subsidy is now being transferred based on the actual sales at the local level rather than being transferred as soon as fertilizer reached the local distribution point. The aim of this shift in subsidy transfers is as follows –

-

-

-

-

- Ensure that there is no diversion of fertilizer aimed for agricultural use to non-agricultural industries.

- Ensure that every farmer can access their desired quantity of fertilizer without shortage.

-

-

-

Further, aside from the inclusion of fertilizer subsidy in DBT to increase the efficiency of subsidies, the Government, in 2015, under the leadership of PM Modi, had also implemented the order to coat 100% of the urea for agricultural purposes with neem oil. This was done with the aim of controlling the release of nitrogen to the soil, which previously suffered from extremely rapid dissolution and absorption, leading to soil and water contamination along with the need for excessive quantities of urea. Additionally, neem-coating was also brought in to prevent siphoning of urea meant for agricultural use to non-agricultural industries.

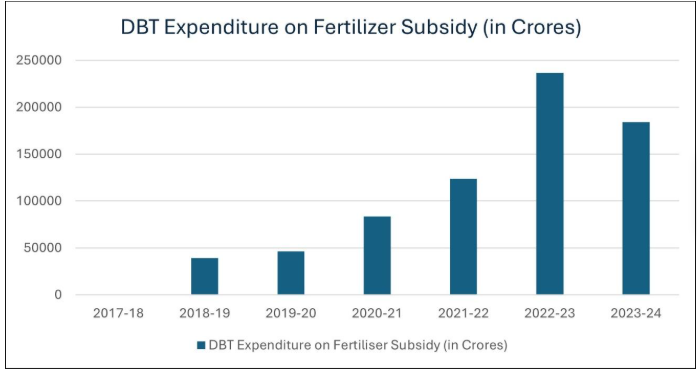

Figure 4 – DBT Expenditure in Fertilizer Subsidy (in Crore Rupees) [Source – DBTBharat]

c. Financial Allocation – The financial outlay for fertilizer has made a smooth transition towards the new regime, which uses DBT to transfer funds in real time to the producers. Right after the end of the pilot program in the first quarter of early 2018, the quantum of subsidy has increased drastically with more than 2 lakh crores being transferred during the financial year 2022-23 (Fig. 4). This has made fertilizer subsidy the biggest scheme (in terms of volume of funds transferred) using the DBT framework. Hence, it is a prime example of the potential of DBT in handling the massive flow of monetary transactions without delay.

d. Impact – The most impressive improvements brought in by the use of the DBT framework for transferring fertilizer subsidy have been the cumulative savings of more than 18,000 crores brought in due to a reduction of 158.06 lakh metric tonnes of fertilizer sales to retailers (DBT Bharat). This reduction has been achieved due to the release of funds, in real time, towards the actual sale of fertilizer, leading to an accurate track of the demand for fertilizer. Hence, the quantity of fertilizer being diverted to non-agricultural use has been eliminated. Additionally, the occurrence of overcharging on fertilizer has also been eliminated due to the generation of a receipt on every purchase containing the MRP of the fertilizer and subsidy paid by the government, resulting in complete transparency during the purchase process. Further, a study done by K.B. Ramappa, Vilas Jadha, and A.V. Manjuntha has showcased that neem-coated urea has had a positive impact on yield levels and the quantity of urea required per area of cultivable land.

The following are the prominent examples from the author’s interview of farmers regarding the impact of DBT on the availability of fertilizer and the effect of neem-coated urea.

-

-

- Shri Naresh Jatav from Hisar district in Haryana recollected his experience facing a shortage of fertilizer before 2018. He expressed that many times he was sent back without getting the required quantity of fertilizer for his farm. The main reason, according to him, for this was the rampant diversion of agricultural fertilizer to the black market, which reduced the number of stocks available. Further, he shared that as a member of the SC community, he has also had its effects, as he had to make several trips to the purchase point to acquire the requisite quantity of fertilizer, many times paying a higher price when compared to farmers belonging to the general castes. However, since the installation of biometric verification devices, Naresh has never had to make multiple trips to purchase fertilizer. Further, instances of over-charging have also disappeared as he can now verify the price he paid against the receipt generated from the Point of Sale (PoS) device.

- Shri Pavan Yadav from Saharanpur in Uttar Pradesh shared his experience of using neem-coated urea for his sugarcane farm. According to him, he used to purchase around 15 bags of [normal] urea for his maize farm. However, since switching to neem-coated urea, he only needs to purchase 8-10 bags. A major reason for this reduction is the slow release of nitrogen in neem-coated urea, resulting in less wastage and soil contamination. Further, Pavan also told that he has also witnessed a marginal improvement in yield due to better absorption of nitrogen by his plants.

-

3.3) PM-Fasal Bima Yojna –

a. Historical Context – Agriculture in India is often characterised by its susceptibility to risks associated with natural calamities and extreme weather events. This fact becomes even more important when we factor in our dependence on rainfall during the monsoon season, which itself is facing a high degree of variability due to climate change. Every year, numerous incidents continue to be reported on crop failure due to droughts, floods, hailstorms and unseasonal rains, among others. The impact of such events has been disastrous on our farmers due to the financial stress involved.

Recognising the potential distress to farmers, multiple crop insurance schemes have been tested out. Starting from the Individual Indemnity-based Crop Insurance Scheme to its successors like the Pilot Crop Insurance Scheme (1979-1984), Comprehensive Crop Insurance Scheme (1985-1999) the National Agriculture Insurance Scheme (NIAS) (1999-2010) and its modified rendition – the Modified National Agriculture Insurance Scheme (MNAIS) (2010-2016), there have been a continuous effort to from the government to insure our farmers against natural calamities. However, due to several reasons, none of these insurance schemes were able to effectively tackle the problem of providing insurance support to most of our farmers. The reasons for this mainly included – delayed and inadequate claims payout, limited coverage of risks, and an unsustainable business model leading to a huge cost to the government exchequer.

b. Aims – Hence, in 2016, a revamped crop insurance scheme, the Pradhan Mantri–Fasal Bima Yojana (PM-FBY) was launched. The primary aim of the scheme remained the same as the previous schemes, which is to provide financial support to farmers through insurance coverage in the event of loss of crop (either partial or complete) due to natural calamities, pests, or diseases. However, PM-FBY aims to provide an improvement on the previous crop insurance schemes in the following manner –

-

-

-

- Reduction in premium rates – PM-FBY aims to bring the farmer’s share of the insurance premium to an affordable rate compared to the previous schemes. In this regard, the premium is fixed at 2% for Kharif crops and 1.5% for Rabi crops.

- Coverage of the entire crop cycle – PM-FBY also covers the loss of crop during the pre-sowing stage, which was not previously covered. Hence, the scheme becomes the first in the country to provide insurance against risk associated with the entire crop cycle (i.e., pre-sowing to post-harvest).

- Use of advanced technology to claim verification and faster processing time – One of the major problems in the previous schemes was the excessive delay in claim verification by the insurance company. Further, the payment settlement also took time as the money was required to be collected by the farmer either in the bank or the government offices. PM-FBY makes major inroads in solving this problem by using advanced technologies like remote-sensing data, drones, and smartphone-based assessment. This has allowed PM-FBY to set a timeline of two months (post-harvest) for processing claims. Further, once the claim is approved, the money is transferred directly to the bank accounts of the farmers, requiring no visits to government institutions.

- Enabling Choice – Since 2020, PM-FBY has removed the compulsory enrolment of loanee farmers for crop insurance. This has made the scheme voluntary for all farmers. Hence, enabling and promoting choice.

-

-

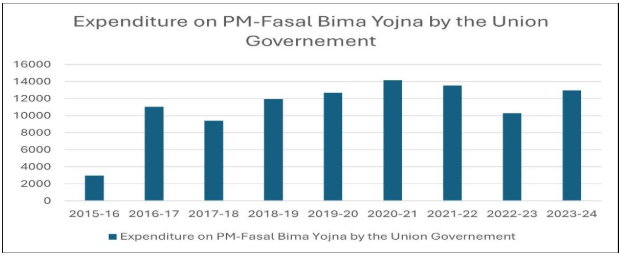

Figure 5 – Expenditure on PM-FBY by the Union Government [Source: Government of India, Expenditure Budget]

c. Financial Allocation – Figure 5 provides a bird’s eye view of the actual expenditure by the Central Government on PM-FBY. It is important to note that since its inception, the annual government expenditure on the scheme, on average, has remained above ₹10,000 crores. This expenditure has been used to provide a share of the premium to the insurance companies in order to ensure that the premium cost to the farmer remains affordable.

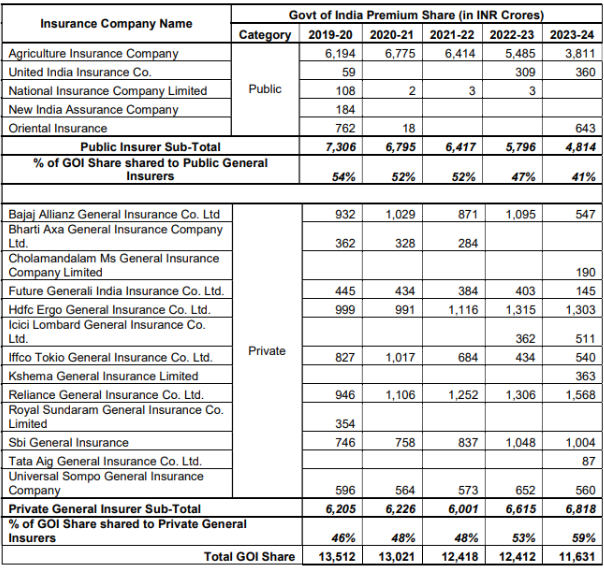

Figure 6 – Government of India Premium Share Across Insurance Providers [Source: sansad.in]

Figure 6 provides the distribution of the Union Government’s funds across insurance companies from 2019-20 to 2023-24. The data highlights that the government has allocated nearly an equal amount of money to both public and private insurance providers. This has been to ensure that the premium rates remain low due to competitive bidding.

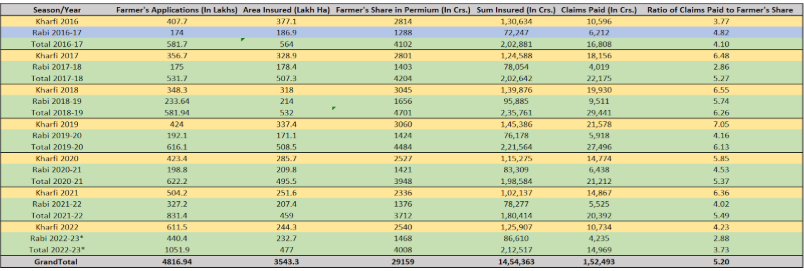

d. Impacts – Since its inception, PM-FBY has been a game-changer in the Indian crop insurance sector. In its first year, the scheme was able to double the number of farmers insured when compared to the previous scheme (i.e., NAIS). Additionally, the average value of sum insured per hectare has also seen a drastic rise from ₹20,500 in Kharif 2015 to ₹34,370 in Kharif 2016 (first season of PM-FBY). The data given in Figure 7 highlights that till the year 2022-23, an amount in excess of rupees one lakh and fifty thousand crores has been paid to help farmers cover their losses. This puts the average annual claim amount at more than rupees twenty thousand crores. Further, in the seven years since the scheme’s launch, the average ratio of farmers’ shares to claims paid is more than 5.2. This means that for every rupee that our farmers have paid in the form of an insurance premium, they have received 5 rupees in return.

Figure 7 – Performance of PM-FBY till 2022-23 (Source – MoAFW, 2024)

In addition to the quantitative study of the improvement in coverage of farmers, sum insured, and quantum of claims paid, it is also important to look at the impact of the scheme on the lives of our farmers. The following are two instances, based on the author’s interviews with farmers, which highlight the effectiveness of the PM-Fasal Bima Yojana:

-

-

- Shri Ramvir Patel, a farmer in Jhansi district of Uttar Pradesh, along with his two brothers, has been growing groundnuts on his 3.5-hectare farm. During the tail end of the Kharif season in 2022, Ramvir was busy harvesting his crops and storing the yield on his farm. On the final day of harvesting, he saw his worst fears come true in the form of a heavy downpour of unseasonal rains, which lasted for three straight days. According to Ramvir, this event led to more than 60% loss of yield, which cost him around ₹1,50,000. His first action after putting his emotions together was to file an insurance claim under PM-FBY, which he had enrolled in at the start of the season by paying a minor sum of ₹3,200 as the insurance premium. Within 45 days of filing a claim, Ramvir received an amount of ₹1,40,000 in his bank account, which helped reduce his losses to less than ₹10,000. According to him, PM-FBY is the reason he was able to save himself and his family from falling into the clutches of bad debts.

- Shri Shubham Bawaskar, a farmer from the Aurangabad district of Maharashtra, was the victim of a severe drought in 2023 while growing soybeans on a 1.5-hectare farm. During sowing, Shubham was hopeful as he would get around 3,000 kgs of yield from his farm even after below-average rainfall. Further, to protect himself from loss, he enrolled himself in PM-FBY by paying a premium of around ₹1,700. However, as September passed, he realised that the rainfall that year was far less than he had anticipated. This led to major issues related to the growth of his crop. At the time of harvest, the yield from his farm was around 1,700 kgs, a shortfall of around 1,300 kgs from his expected yield. This loss in crop cost Shubham around ₹60,000, which prompted him to immediately file a claim under PM-FBY. Shubham was astonished by the pace of processing under the scheme, as he received an amount of ₹45,000 within 40 days of filing the claim. Further, Shubham also expressed his satisfaction that he received the entire amount straight into his bank account. Since that year, Shubham has raised awareness about the insurance scheme among his fellow farmers in the village, as he considers the scheme to be a lifeline for farmers during instances of crop loss.

-

4. CONCLUSION

Direct Benefit Transfer has recast India’s farm-support architecture by wiring resources straight to cultivators and tethering every rupee to a verifiable beneficiary. Across income support, input subsidy, and risk-mitigation schemes, the effects converge on three outcomes: speed, savings, and self-determination. PM-KISAN now lands ₹6,000 a year in more than nine crore accounts, giving marginal holders liquidity to buy seed, rent machinery, or absorb medical and education shocks without visiting moneylenders. Fertilizer payments, released only after biometric sales, have trimmed diversion by 158 lakh tonnes and saved the exchequer over ₹18,000 crore while ending arbitrary over-pricing at retail counters (DBT Bharat, 2024). PM-Fasal Bima Yojana completes the safety net: farmers who pay barely 1.5–2% of premium have already received claims exceeding ₹1.5 lakh crore—more than a five-fold return—within mandated 60-day windows, thanks to remote-sensing verification (MoAFW, 2024). Together, these platforms translate fiscal outlays into tangible resilience: yields rise when fertilizer arrives on time; consumption stabilises when income top-ups cushion shocks; and psychological security improves when drought losses are reimbursed before the next sowing. By collapsing leak-prone hierarchies into a transparent digital spine, DBT restores dignity to farm families and anchors a more productive, climate-ready rural economy.

The views and opinions expressed here belong solely to the author and do not reflect the views of BlueKraft Digital Foundation.