The Union Budget delivered on multiple fronts, shutting down all rhetoric of an uneventful, business-as-usual budget. The most remarkable reform was proposed in the Finance Bill, with significant revisions to the income tax rates. The government has provided massive tax relief across income classes, especially to encourage India’s aspiring neo-middle class. While this might be identified as populist policymaking, it will have positive impacts on development. First, higher consumption will spur aggregate demand and, in turn, growth. Second, the rate cut introduced by the Reserve Bank of India will further strengthen the consumption multiplier while invigorating investment demand.

Shifting the focus to consumption-led growth

Unlike the East Asian tigers or growth miracles of the previous century, India’s growth trajectory has not followed the export-led, manufacturing-dominant strategy. While services have played a crucial role on the supply side, it is often overlooked that India’s growth has been demand-driven—it follows a consumption-led growth path. This is evident from the predominant share of consumption in GDP (C/Y) and the co-movement of their growth paths (barring shock outliers). This phenomenon has been further solidified in the last decade, with a stronger association between GDP and consumption growth. Thus, direct stimulation to consumption through increased disposable incomes is likely to have a significant multiplier effect on growth.

According to the new proposed rates, the finance minister expects a loss of revenue of INR 1 lakh crore in direct taxes. For consistent analysis, income tax return statistics for the year 2023-24 have been used to estimate the costs and benefits of the proposed change. In 2023-24, out of 9.1 crore taxpayers, 7.6 crore filed their taxes. This means that out of the 64 crore workers in India, only about 15% pay taxes. However, the number of taxpayers has recorded a significant increase, growing by 82% in the last decade. Using the income distribution statistics, it is found that almost 90% of tax filers will be exempt from paying any income tax, eliminating tax obligations for an additional 50 lakh individuals.

Economic Benefits of the Tax Cut

The net difference in tax revenue will be around INR 80,000 crore (this was estimated using averages for each income category and comparing the change in tax obligations). In other words, Indian consumers will have an additional income of INR 80,000 crore at their disposal. The aggregate effect of this transfer would be much higher owing to the multiplier mechanism—the successive rounds of injection into the economy due to its circular nature. For simplicity, consider India’s gross savings rate of around 30%. Thus, 70% of income is spent on consumption (average propensity to consume, or APC). This is taken to be the marginal propensity to consume (MPC). In other words, it has been assumed that consumers will treat the income gain as regular income and spend a proportionate share. It should be noted that this is a strained assumption since MPC, being equated to APC, is usually applicable at high-income levels.

Notwithstanding the approximation, the multiplier effect can lead to an increase in consumption expenditure by INR 2.5 lakh crore or 1.25%. This will be directly reflected in GDP growth, resulting in nominal growth of around 11% in 2025-26. Moreover, assuming that India is operating in the prohibitive range of the Laffer curve, the gradual increase in tax revenue will enhance the ease of fiscal consolidation. Considering the prudent stance of the government in line with the Fiscal Rules and Budget Management Act (FRBMA), lower public borrowing in the following years will soften inflation. The resultant lower deflator can provide real economic growth to the tune of 8 percent and above.

The Double Dividend of a Rate Cut

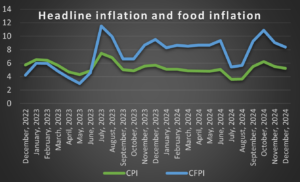

The Monetary Policy Committee (MPC) has revised the repo rate from 6.5% to 6.25%—the first rate cut since December 2022. During this period, unemployment has been stable around the 3.2% range, and inflation (CPI) has moderated since the second half of 2023. However, inflationary concerns emerged from higher vegetable prices, which have been addressed through long-run measures of improving supply chains in the current budget. Since food price inflation is unlikely to react to rate changes, this move, in isolation, should not drive up inflation. The rate cut will, however, encourage greater spending due to the lower cost of credit and inject a second round of stimulus into the economy. The monetary stance indicates that India can potentially deliver 8% growth in the coming fiscal year.

Fig: A correlation between the Consumer Price Index (CPI) and the Consumer Food Price Index (CFPI)

At lower rates, people tend to hold more money and increase their discretionary spending. This is due to the lower cost of borrowing for purchasing assets, which leaves more money in their hands to spend on consumables. Thus, the rate cut will strengthen the consumption multiplier and amplify the expansionary effects of the tax cut. More importantly, the lower cost of borrowing will incentivize investment, leading to greater private capital expenditure. The much-needed upswing in private capital expenditure (capex) will be facilitated by the rate cut while also strengthening the crowding-in effect of public capex. This can forge the medium- to long-run pathway for economic growth by solidifying domestic investment and reinvigorating business confidence. Moreover, these policies will yield efficient outcomes when business and consumer confidence in the monetary and fiscal authorities is high—delineating the need for policy consistency.

Implications for Viksit Bharat

India needs a structural shift in its growth rate to realize the goal of becoming a high-income nation by 2047. Besides strengthening demand, the increase in disposable income due to the new tax structure will facilitate greater capital accumulation through the savings channel. The gradual escalation of the savings rate can initiate the self-sufficient, industry-heavy growth trajectory that the nation has been seeking. The lower interest rates will also promote investment. Ensuring the passage of stimulus between demand and supply will play a critical role in deciding the growth momentum. For instance, greater consumption will translate into higher demand for services, boosting production and exports—if there are no expansion constraints. Thus, the likelihood of achieving Viksit Bharat by 2047 can be bolstered by policy consistency, innovation, and promptness.

The views and opinions expressed here belong solely to the author and do not reflect the views of BlueKraft Digital Foundation.